Save with 5% off plus free shipping on all orders with GearPass. Sign up now.

Great news for our valued customers! We're excited to announce that we now offer tax-exempt purchasing options. At Tyndale FRC, we understand the importance of maximizing your savings, which is why we've streamlined the process to make it easier than ever for qualifying customers to enjoy tax-exempt purchases. Whether you're a nonprofit organization, government entity, or eligible business, this initiative is designed to enhance your experience and provide even greater value. Explore our range of products and services with confidence, knowing that you can now enjoy the benefits of tax exemption. Discover how Tyndale FRC is dedicated to empowering your success while saving you time and money.

To ensure a seamless experience in placing a tax-exempt order, the initial step is simple: submit a copy of your tax-exempt certificate before placing your order. This vital documentation allows us to verify your tax-exempt status efficiently and configure your customer account as tax-exempt.

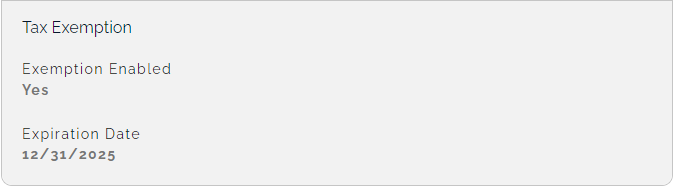

After submitting your tax-exempt certificate, keep an eye on your account to track when your tax-exempt status has been activated. We understand the importance of timely access to tax-exempt purchasing, and our team works diligently to expedite the verification process. Once enabled, you will see the exemption enabled status and expiration date update on your account dashboard (shown below). Thank you for your patience as we work to enhance your purchasing experience at Tyndale FRC.

To submit your tax-exempt certificate:

- Log in to your Tyndale FRC Marketplace account.

- Select My Account.

- Click Submit Tax-Exempt Certificate at the top of your dashboard.

This opens a blank email in your email client with Tyndale as the recipient. Attach your updated certificate and press send. Once reviewed and approved, your account will be placed under tax exemption.

Tax-exempt certificates are typically reviewed within a few business days. To check your approval status:

- Log in to your Tyndale FRC Marketplace account.

- Select My Account.

- Scroll down to the Tax Exemption section.

If your certificate is approved, you’ll see a Yes under Exemption Enabled with your certification’s expiration date. All accounts default to No – if you recently submitted your certificate, that status may not be updated yet. If you have questions, our Customer Service team is happy to help.

Yes, you can check the status of your tax exemption directly in your Tyndale FRC Marketplace account. To view your status:

- Log in to your Tyndale FRC Marketplace account.

- Select My Account.

- Scroll down to the Tax Exemption section.

If your certificate is approved, you’ll see a Yes under Exemption Enabled with your certification’s expiration date. All accounts default to No – if you recently submitted your certificate, that status may not be updated yet. If you have questions, our Customer Service team is happy to help.

Yes. Applicable taxes are charged at checkout while your tax-exempt certificate is under review. Once your certificate is approved, future orders will reflect your tax-exempt status. If you have questions or need assistance, our Customer Service team is happy to help.

Yes. Once your certificate is approved, future orders will reflect your tax-exempt status.